Interest Rates DO Make a Difference

Recently one of my sons and his girlfreind purchased a home for $400,000 and he asked me "Dad, what happens if my house loses 10% of its value?". My answer was "Well, you are a math major, so you know you just lost $40,000 but let me ask you this.... If you buy that same house at 10% less for $360,000 BUT the interest rates were at 6% vs. the 4% how much more would you be paying a month?"

Recently one of my sons and his girlfreind purchased a home for $400,000 and he asked me "Dad, what happens if my house loses 10% of its value?". My answer was "Well, you are a math major, so you know you just lost $40,000 but let me ask you this.... If you buy that same house at 10% less for $360,000 BUT the interest rates were at 6% vs. the 4% how much more would you be paying a month?"

Interestingly, a $350,000 loan at 4% is $1,671 a month BUT if that same house dropped 10% and the loan is now $310,000 (same $50k down off a now lower $360k purchase price) that payment is $1,859 or a whopping $188 a month more for a $40,000 cheaper home! So it shows the importance of lower interest rates.

Yes, I know at 4% they are higher than where we bottomed out in the high 2% range back in the middle of the recession, but they are still historically very low, well lower than the long time average rate of 8.2% (yes I am old enough to remember them peaking at about 19%). So if you are concerned about our rising prices and still looking to buy a home, clearly now is one of the best times in recent years to do so. Contact us today and let us know how we can help.

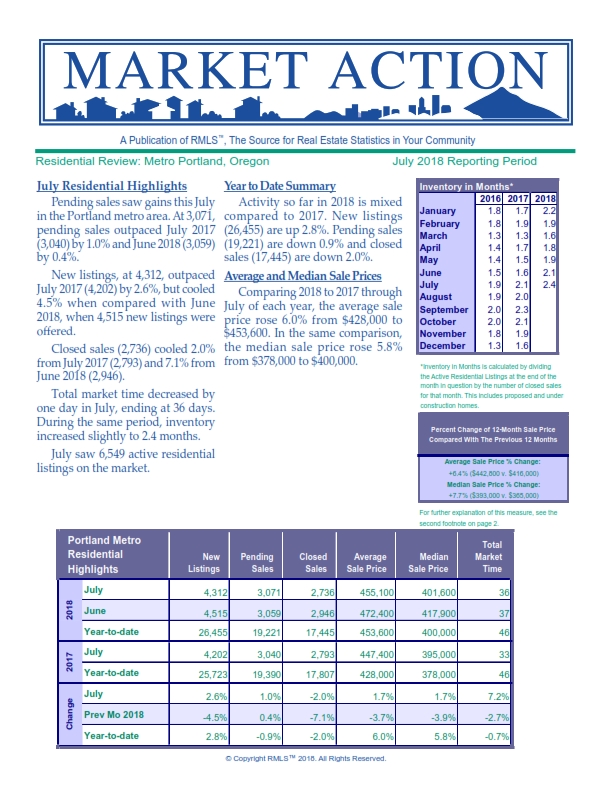

The June 2018 numbers are out for housing in the Portland Metro area and as expected they are down a little from May. Typically our sales drop in the summer a little bit, so its a GREAT time to buy a home as buyers are (a little) more in the drivers seat.

The June 2018 numbers are out for housing in the Portland Metro area and as expected they are down a little from May. Typically our sales drop in the summer a little bit, so its a GREAT time to buy a home as buyers are (a little) more in the drivers seat.  This is an interesting article given how it affects us.... Oregon is the 7th hottest market for incomes increasing as our employment continues to increase. GIven our home prices are significantly lower than say Seattle, our big neighbor to the north and also that Seattle's incomes are higher, this may affect our housing market significantly. We are already seeing people move their companies to Portland from the LA and Bay area markets due to their employees not being able to afford a house but many have gone in the past to Seattle, skipping Portland altogether. Now we may see more of this migration.

This is an interesting article given how it affects us.... Oregon is the 7th hottest market for incomes increasing as our employment continues to increase. GIven our home prices are significantly lower than say Seattle, our big neighbor to the north and also that Seattle's incomes are higher, this may affect our housing market significantly. We are already seeing people move their companies to Portland from the LA and Bay area markets due to their employees not being able to afford a house but many have gone in the past to Seattle, skipping Portland altogether. Now we may see more of this migration.