55+ Housing Market Ticks Back Up to Record High

_001.jpg) This is an interesting article as I'm living it! Let me digress.... When I started selling real estate in Portland nearly 31 years ago, I mostly sold to my sphere, so other young families with kids. Now fast forward those 31 years and most of those clients are either downsizing, or their parents are moving into independent/assisted living, or passing. As a result a large part of my business is selling homes for seniors, and helping 55+ buyers find homes with a master on the main floor. My wife Beverly and I did just this three years ago.

This is an interesting article as I'm living it! Let me digress.... When I started selling real estate in Portland nearly 31 years ago, I mostly sold to my sphere, so other young families with kids. Now fast forward those 31 years and most of those clients are either downsizing, or their parents are moving into independent/assisted living, or passing. As a result a large part of my business is selling homes for seniors, and helping 55+ buyers find homes with a master on the main floor. My wife Beverly and I did just this three years ago.

Check out the article, remembering its from the National Association of Home Builders so talks about new homes. Let me know your thoughts or if you know anyone looking to downsize. http://nahbnow.com/2019/10/55-housing-market-ticks-back-up-to-record-high/

I saw a great article recently on The Motley Fool website about how rental properties are taxed. My wife and I have invested in rental homes for many years, some we do out of our personal accounts and some out of our retirement accounts. There are some huge tax advantages to doing either and I am always happy to discuss, but many people ask me "what can I write off on a rental". This article covers this well. The key is even if you think you arent making money on a rental, after taxes and depreciation you are (and thats not counting appreciation).

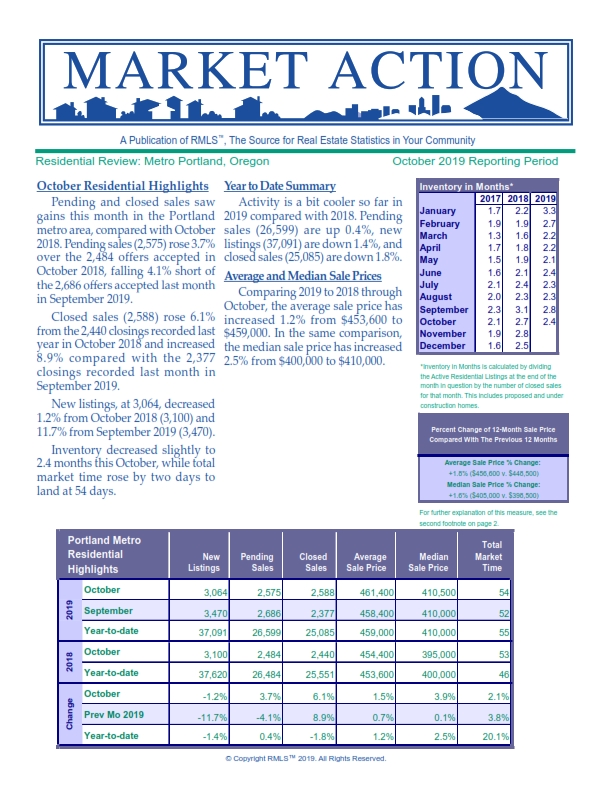

I saw a great article recently on The Motley Fool website about how rental properties are taxed. My wife and I have invested in rental homes for many years, some we do out of our personal accounts and some out of our retirement accounts. There are some huge tax advantages to doing either and I am always happy to discuss, but many people ask me "what can I write off on a rental". This article covers this well. The key is even if you think you arent making money on a rental, after taxes and depreciation you are (and thats not counting appreciation). The latest stats came out from the Portland area MLS for the month ending October 31st, 2019 and here they are. Pending and closed sales saw some gains in October when compared to 2018 with pending sales up 3.7%, but down 4.1% when compared to September of this year. For closed sales (keeping in mind the average closing time is about 40ish days) rose 6.7% over last year AND rose 8.9% over September of this year with 2,377 closed sales registered for the Portland metro area (not including Washington State).

The latest stats came out from the Portland area MLS for the month ending October 31st, 2019 and here they are. Pending and closed sales saw some gains in October when compared to 2018 with pending sales up 3.7%, but down 4.1% when compared to September of this year. For closed sales (keeping in mind the average closing time is about 40ish days) rose 6.7% over last year AND rose 8.9% over September of this year with 2,377 closed sales registered for the Portland metro area (not including Washington State).