Myth: You Need a 20% Down Payment to Buy a Home

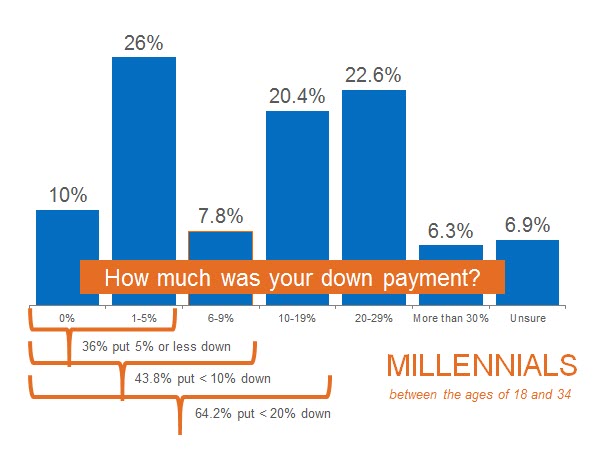

Gone are the days of 20% down or no loan, but recent surveys reveal that many Americans are not aware that programs exist to put down less. Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.” The survey results revealed that consumers often overestimate the down payment funds needed to qualify for a home loan; 76% of respondents either don’t know (40%) or are misinformed (36%) You Need a 20% Down Payment to Buy a Home Myth 2: about the minimum down payment required. Many believe that they need at least 20% down to buy their dream home, but many programs actually let buyers put down as little as 3%. On the right are the results of a Digital Risk survey of Millennials who recently purchased homes. Since Millennials make up the largest share of first-time buyers, it should come as no surprise that 97% of this generation financed their home purchase, compared to 86% of all buyers. What may come as a surprise to many who have not yet purchased, however, is that 16% of those who financed their home put 0% down! 61% of Millennials who purchased a home in 2016 put down 10% or less! According to data from the last 12 months of Ellie Mae’s Millennial Tracker, the average down payment for a Millennial was 10%. Your dream home could be within your reach much sooner than you ever thought if you only need to save up 3-10% instead of the 20% that you may have thought you needed!

Gone are the days of 20% down or no loan, but recent surveys reveal that many Americans are not aware that programs exist to put down less. Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.” The survey results revealed that consumers often overestimate the down payment funds needed to qualify for a home loan; 76% of respondents either don’t know (40%) or are misinformed (36%) You Need a 20% Down Payment to Buy a Home Myth 2: about the minimum down payment required. Many believe that they need at least 20% down to buy their dream home, but many programs actually let buyers put down as little as 3%. On the right are the results of a Digital Risk survey of Millennials who recently purchased homes. Since Millennials make up the largest share of first-time buyers, it should come as no surprise that 97% of this generation financed their home purchase, compared to 86% of all buyers. What may come as a surprise to many who have not yet purchased, however, is that 16% of those who financed their home put 0% down! 61% of Millennials who purchased a home in 2016 put down 10% or less! According to data from the last 12 months of Ellie Mae’s Millennial Tracker, the average down payment for a Millennial was 10%. Your dream home could be within your reach much sooner than you ever thought if you only need to save up 3-10% instead of the 20% that you may have thought you needed!

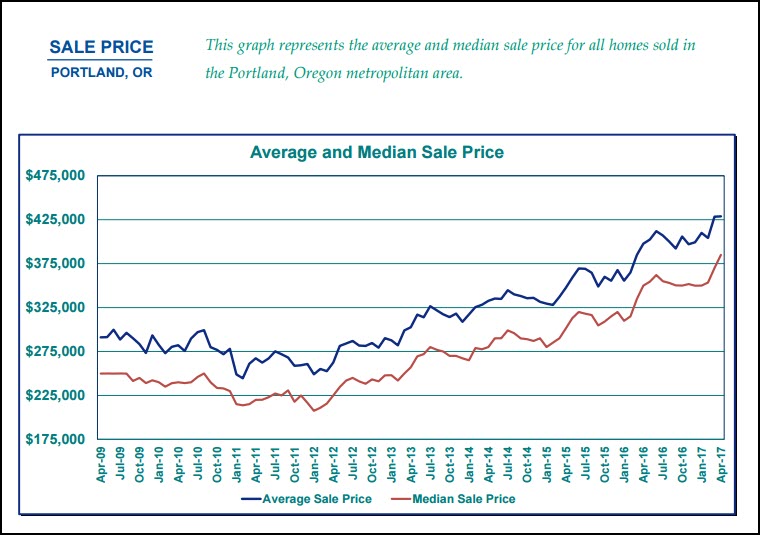

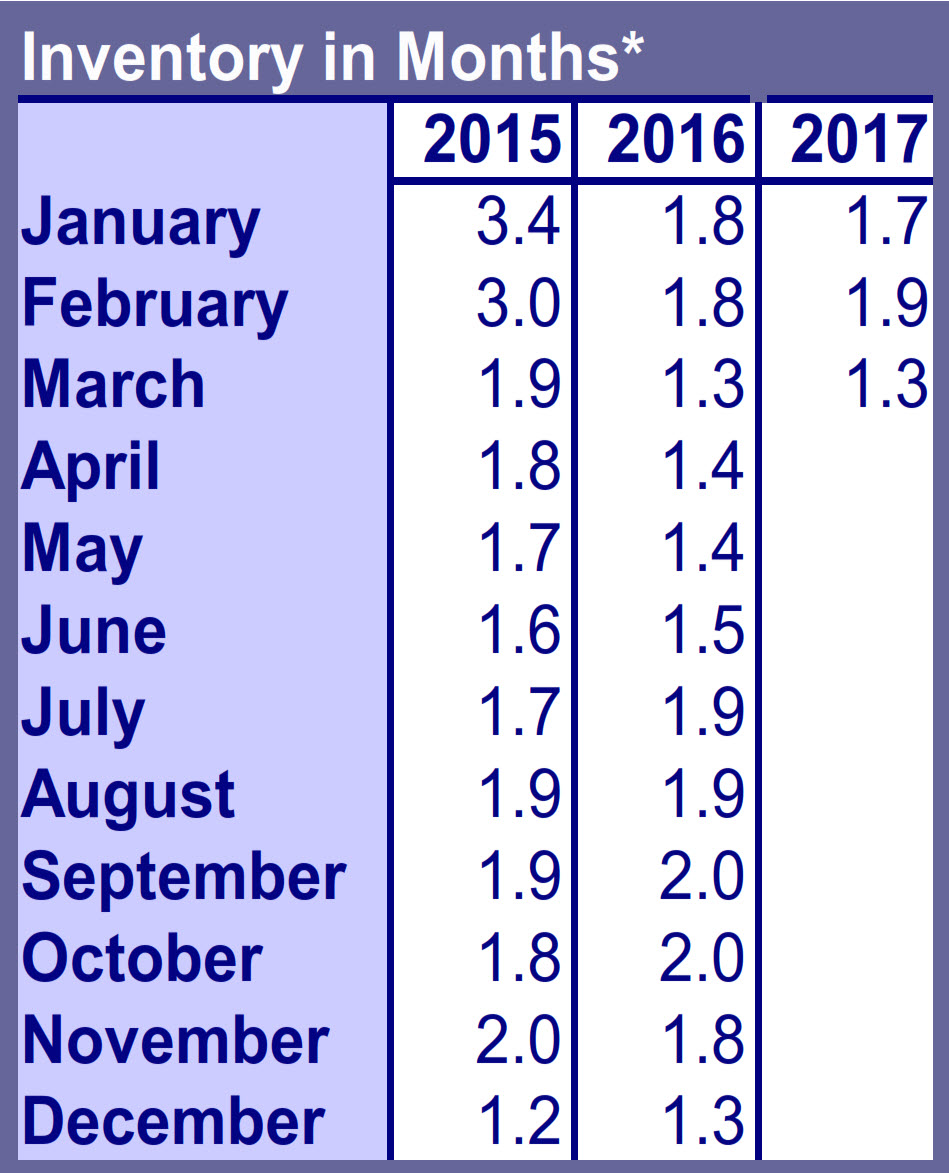

The Portland metro area saw some mixed real estate activity this April, while the year to date still remains cooler compared to 2016. New listings, at 3,759, fared 4.3% better than last month in March 2017 (3,604), but fell 7.9% short of the 4,082 new listings offered last year in April 2016. Similarly, pending sales (3,088) were 10.0% cooler than in April 2016 (3,432) but showed a modest 1.5% gain over last month in March 2017 (3,043). Closed sales, at 2,219, fell 11.0% short compared to last month’s 2,494 closings and 15% short compared to the 2,611 closings recorded last year in April 2016. Inventory crawled upward in April, ending at 1.7 months. Total market time decreased by four days, ending at 42 days. There were 3,753 active residential listings in the Portland metro area in April.

The Portland metro area saw some mixed real estate activity this April, while the year to date still remains cooler compared to 2016. New listings, at 3,759, fared 4.3% better than last month in March 2017 (3,604), but fell 7.9% short of the 4,082 new listings offered last year in April 2016. Similarly, pending sales (3,088) were 10.0% cooler than in April 2016 (3,432) but showed a modest 1.5% gain over last month in March 2017 (3,043). Closed sales, at 2,219, fell 11.0% short compared to last month’s 2,494 closings and 15% short compared to the 2,611 closings recorded last year in April 2016. Inventory crawled upward in April, ending at 1.7 months. Total market time decreased by four days, ending at 42 days. There were 3,753 active residential listings in the Portland metro area in April.  This article in the Oregonian last week talks about even though the Portland area has grown, we have recently been leapfrogged by both San Antonio, Texas and Orlando, Florida in population. The Portland metro area's population now is over 2.4 million, up 1.7% from last year.

This article in the Oregonian last week talks about even though the Portland area has grown, we have recently been leapfrogged by both San Antonio, Texas and Orlando, Florida in population. The Portland metro area's population now is over 2.4 million, up 1.7% from last year.  This article in the New York Times recently talks mostly about the boom in Denver (a city with similar price increases and inventory woes as Portland) But I can tell you as a Realtor for almost 30 years now in Portland while we have always been known as "pot friendly" and I have always had 3-5 people a year asking me about grow operations this last 12 months or so its coming up all the time! Oregon has some specific laws on what you can do personally (grow up to four plants) but we have had several real estate sales recently for buyers in the cannabis industry.

This article in the New York Times recently talks mostly about the boom in Denver (a city with similar price increases and inventory woes as Portland) But I can tell you as a Realtor for almost 30 years now in Portland while we have always been known as "pot friendly" and I have always had 3-5 people a year asking me about grow operations this last 12 months or so its coming up all the time! Oregon has some specific laws on what you can do personally (grow up to four plants) but we have had several real estate sales recently for buyers in the cannabis industry.  March Residential Highlights The Portland metro area hada sunny month for new listings this March. At 3,604, new listings outpaced March 2016 (3,409) by 5.7% and February 2017 (2,521) by 43.0%. This was the strongest March for new listings in the area since 2010, when 4,987 were offered for the month. Pending sales (3,043) warmed 28.5% over last month in February 2017 (2,369) but fell 1.1% short of the 3,076 offers accepted during this month last year in March 2016. Closed sales, at 2,494, similarly outpaced February 2017 (1,669) by 49.4% but still ended 2.8% cooler than in March 2016 when 2,565 closings were recorded for the month. Total market time decreased by four days this March, ending at 58 days.

March Residential Highlights The Portland metro area hada sunny month for new listings this March. At 3,604, new listings outpaced March 2016 (3,409) by 5.7% and February 2017 (2,521) by 43.0%. This was the strongest March for new listings in the area since 2010, when 4,987 were offered for the month. Pending sales (3,043) warmed 28.5% over last month in February 2017 (2,369) but fell 1.1% short of the 3,076 offers accepted during this month last year in March 2016. Closed sales, at 2,494, similarly outpaced February 2017 (1,669) by 49.4% but still ended 2.8% cooler than in March 2016 when 2,565 closings were recorded for the month. Total market time decreased by four days this March, ending at 58 days.