This months video covers three subjects.... The huge and recent increase in home ownership in the United States, what a difference a $300,000 mortgage is by decade and an update on the super hot Portland real estate market. You can see the video by CLICKING HERE.

This months video covers three subjects.... The huge and recent increase in home ownership in the United States, what a difference a $300,000 mortgage is by decade and an update on the super hot Portland real estate market. You can see the video by CLICKING HERE.

Real Estate Market

Portland Real Estate Update By Rob Levy

Portland Real Estate Update August 2020

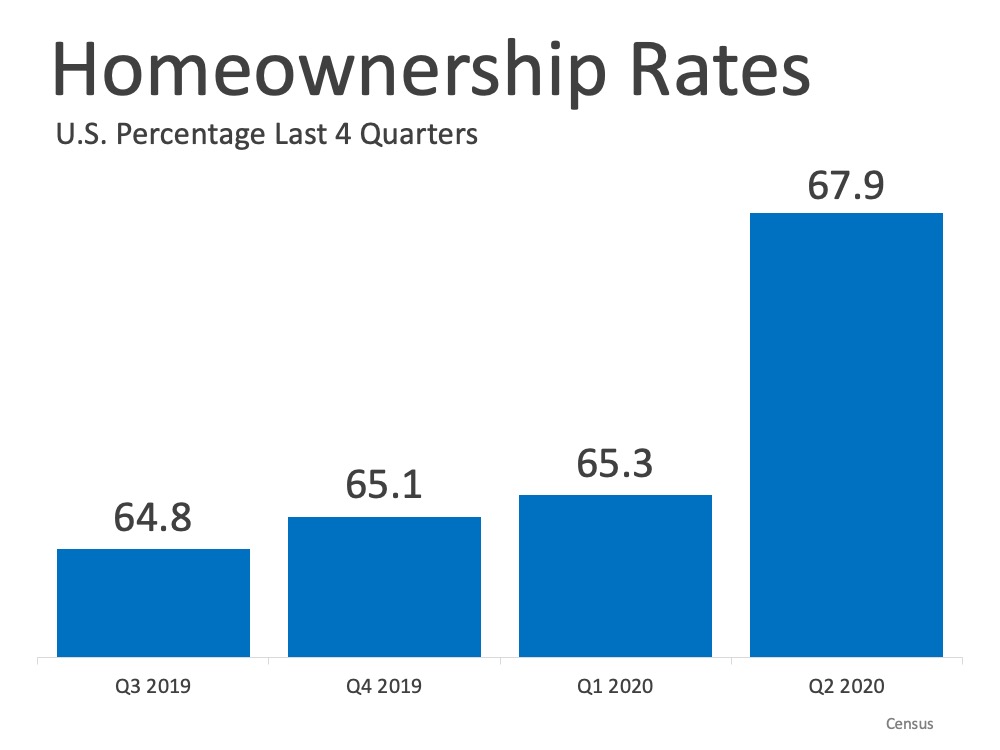

Homeownership is WAY Up

As you can see by this chart, the homeownership rate in America is way up from just over 64% in Q3 of 2019 to just Q2 of 2020. This is good for several reasons not the least of which is that upon retirement, the average homeowner has a tremendous amount more assetts than a renter.

As you can see by this chart, the homeownership rate in America is way up from just over 64% in Q3 of 2019 to just Q2 of 2020. This is good for several reasons not the least of which is that upon retirement, the average homeowner has a tremendous amount more assetts than a renter.

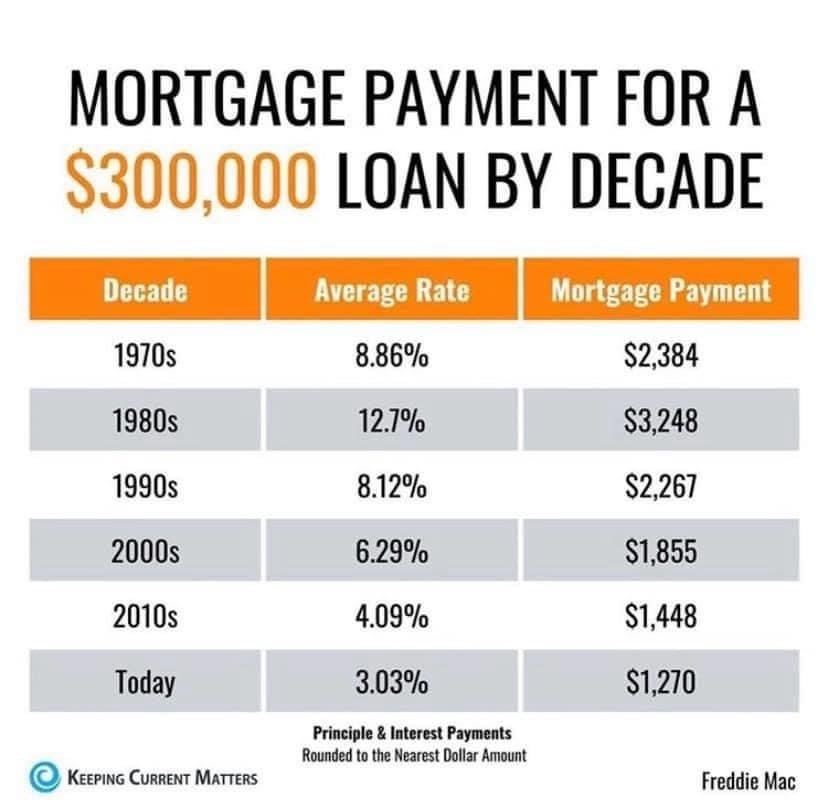

Mortgage Comparison

This one I think is fascinating. Look how a $300,000 mortgage compares today with the same loan amount in the early 2000's or 1980's. Its amazing how much more home one can get today for the same payment, or how much lower the payment is on a similar house.

This one I think is fascinating. Look how a $300,000 mortgage compares today with the same loan amount in the early 2000's or 1980's. Its amazing how much more home one can get today for the same payment, or how much lower the payment is on a similar house.