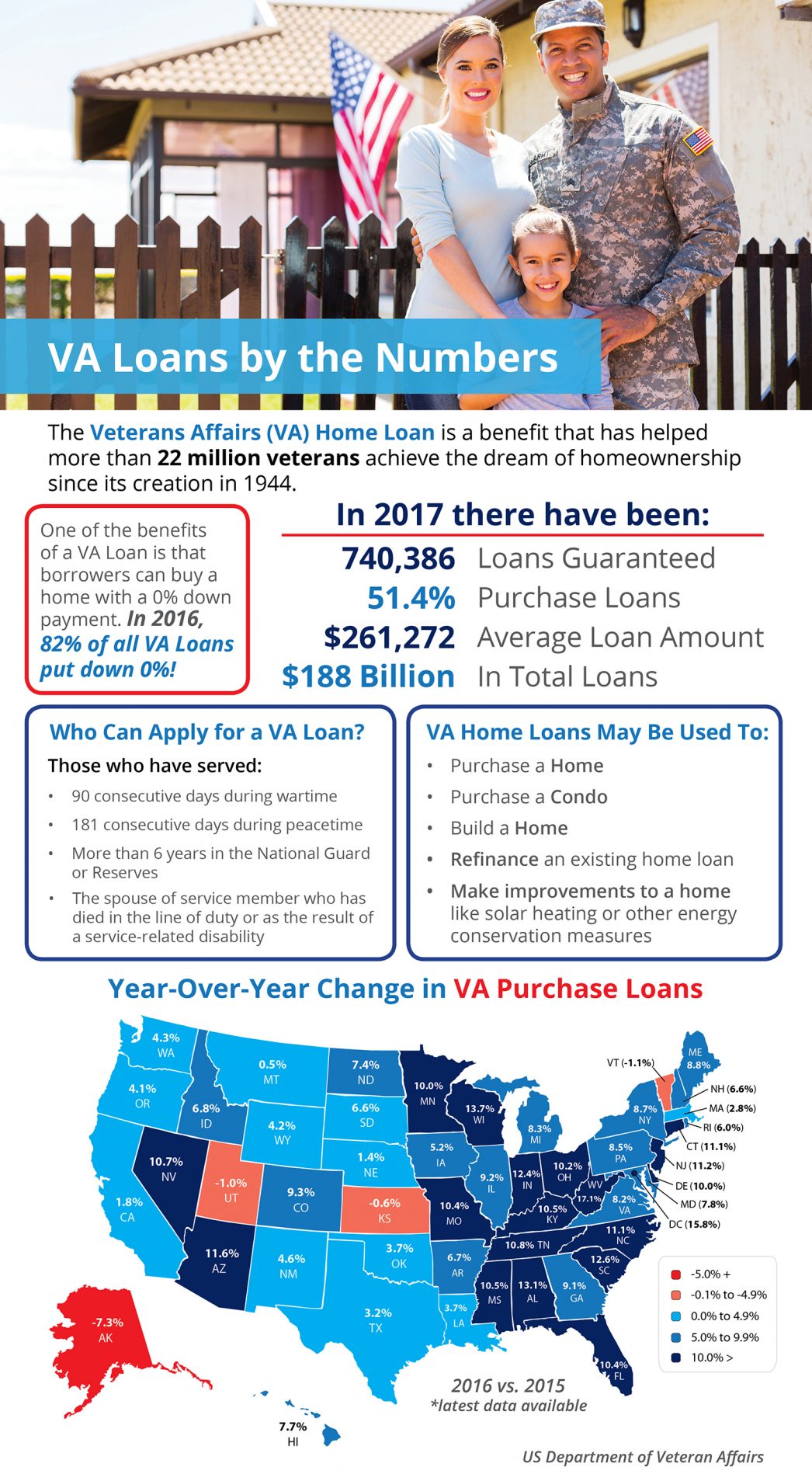

Veterans Affairs Loans in Oregon

Most people are aware of the VA's veterans loan department, where active duty and retired veterans can use a federal guarantee to purchase a home for as little as $1 down. But living in Oregon, the only state in the USA without a large full time active duty military base we dont see that many VA loans. With veterans returning from overseas duty we are seeing more of them. This is one of THE BEST loan programs available and given the constant rise over time of housing since the end of WW2 this is a tremendous opportunity for veterans young and old to obtain a home loan. THIS SITE from the VA shows all the loan types availab

Most people are aware of the VA's veterans loan department, where active duty and retired veterans can use a federal guarantee to purchase a home for as little as $1 down. But living in Oregon, the only state in the USA without a large full time active duty military base we dont see that many VA loans. With veterans returning from overseas duty we are seeing more of them. This is one of THE BEST loan programs available and given the constant rise over time of housing since the end of WW2 this is a tremendous opportunity for veterans young and old to obtain a home loan. THIS SITE from the VA shows all the loan types availab

The Portland Oregonian recently released a report showing the 15 neighborhoods in metropolitan Portland/Vancouver where the average prices are growing the fastest. I'll bet you are guessing inner SE, or maybe NE Portland but you might be surprised! in fact Woodburn prices are up over 22%, and Lake Oswego's lofty average price of over $500,000 is up over 18%.

The Portland Oregonian recently released a report showing the 15 neighborhoods in metropolitan Portland/Vancouver where the average prices are growing the fastest. I'll bet you are guessing inner SE, or maybe NE Portland but you might be surprised! in fact Woodburn prices are up over 22%, and Lake Oswego's lofty average price of over $500,000 is up over 18%.