Portland Oregon Real Estate Update / November 2018

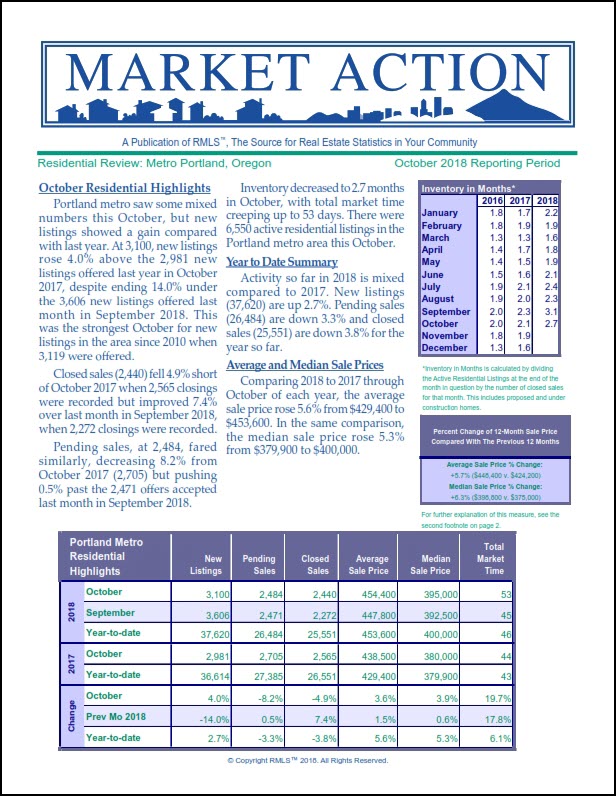

The Portland, Oregon real estate market's latest stats are in for October, 2018 courtesy RMLS. The local market continues to cool somewhat with new listings down 14% over September, which was also down 14.4% over August. Pending sales (homes with an agreed upon sales contract, but not yet closed) were up 0.5% over September, but September was also down some 10.5% over August. Closed sales for October (which in most cases went pending in September) improved 7.4% over September when they were down a whopping 23.4% over August so thats some good news! Inventory crept up to 53 days average selling time although we and othere top local Realtors are seeing a steady increase, especially over about $400,000 in home value.

The Portland, Oregon real estate market's latest stats are in for October, 2018 courtesy RMLS. The local market continues to cool somewhat with new listings down 14% over September, which was also down 14.4% over August. Pending sales (homes with an agreed upon sales contract, but not yet closed) were up 0.5% over September, but September was also down some 10.5% over August. Closed sales for October (which in most cases went pending in September) improved 7.4% over September when they were down a whopping 23.4% over August so thats some good news! Inventory crept up to 53 days average selling time although we and othere top local Realtors are seeing a steady increase, especially over about $400,000 in home value.

Comparing 2018 with 2017 so far, the average sales price is up 5.6% from $429,900 to $453, 600. To see the FULL 7 page report, CLICK HERE!

Our featured home of the month is a terrific single level home in the Garden Home area. Built in 1992 this home features wood and laminate floors, lots of vaulted ceilings, open and bright kitchen, living room AND family room with fireplace and on a large corner lot minutes from downtown Portland and Beaverton. Check it out by CLICKING HERE

CLICK HERE TO HELP CHOOSE THE CHARITY!

CLICK HERE TO HELP CHOOSE THE CHARITY! This article, as seen in Readers Digest talks about 13 projects that you can easily do on your home that pay off big in both resale value if you sell, as well as for your enjoyment while you live there. It is an interesting article in that is also estimates the added value of your home after each project is done.

This article, as seen in Readers Digest talks about 13 projects that you can easily do on your home that pay off big in both resale value if you sell, as well as for your enjoyment while you live there. It is an interesting article in that is also estimates the added value of your home after each project is done.  This article as seen in The Portland Business Journal identifies the top 50 most sought after zip codes in the Portland Metro area.

This article as seen in The Portland Business Journal identifies the top 50 most sought after zip codes in the Portland Metro area.

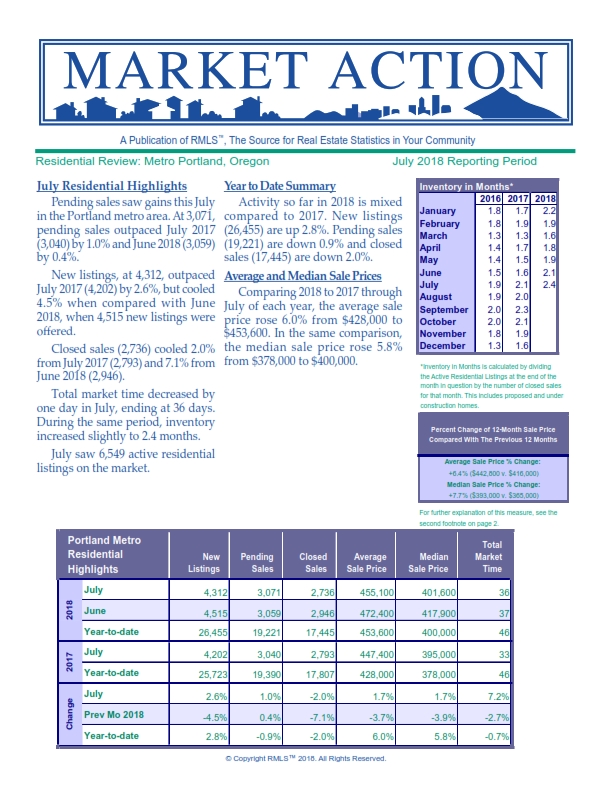

The June 2018 numbers are out for housing in the Portland Metro area and as expected they are down a little from May. Typically our sales drop in the summer a little bit, so its a GREAT time to buy a home as buyers are (a little) more in the drivers seat.

The June 2018 numbers are out for housing in the Portland Metro area and as expected they are down a little from May. Typically our sales drop in the summer a little bit, so its a GREAT time to buy a home as buyers are (a little) more in the drivers seat.  This is an interesting article given how it affects us.... Oregon is the 7th hottest market for incomes increasing as our employment continues to increase. GIven our home prices are significantly lower than say Seattle, our big neighbor to the north and also that Seattle's incomes are higher, this may affect our housing market significantly. We are already seeing people move their companies to Portland from the LA and Bay area markets due to their employees not being able to afford a house but many have gone in the past to Seattle, skipping Portland altogether. Now we may see more of this migration.

This is an interesting article given how it affects us.... Oregon is the 7th hottest market for incomes increasing as our employment continues to increase. GIven our home prices are significantly lower than say Seattle, our big neighbor to the north and also that Seattle's incomes are higher, this may affect our housing market significantly. We are already seeing people move their companies to Portland from the LA and Bay area markets due to their employees not being able to afford a house but many have gone in the past to Seattle, skipping Portland altogether. Now we may see more of this migration.

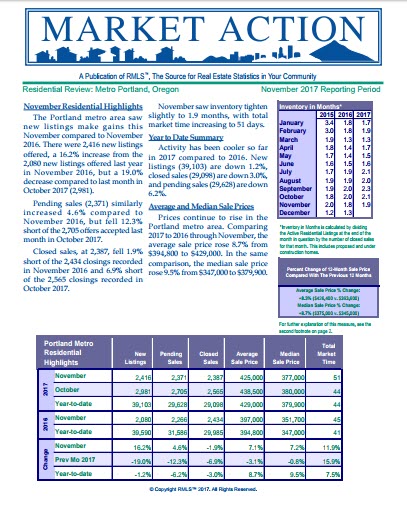

In November, 2017 the Portland metro area saw gains in the number of listings compared to November of last year. There were 2,416 new listings, a 16.2% increase over last year BUT a 19% decrease compared to last month. Pending sales also increased 4.6% compared to November 2016, but fell 12.3% compared to last month (October 2017). Closed sales at 2,387 fell 1.9% short of the 2,434 closings recorded in November last year and also 6.9% short of the 2,565 closings in October 2017.

In November, 2017 the Portland metro area saw gains in the number of listings compared to November of last year. There were 2,416 new listings, a 16.2% increase over last year BUT a 19% decrease compared to last month. Pending sales also increased 4.6% compared to November 2016, but fell 12.3% compared to last month (October 2017). Closed sales at 2,387 fell 1.9% short of the 2,434 closings recorded in November last year and also 6.9% short of the 2,565 closings in October 2017.