Friday, November 15, 2019

by Rob Levy

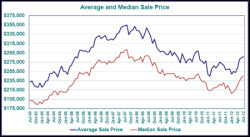

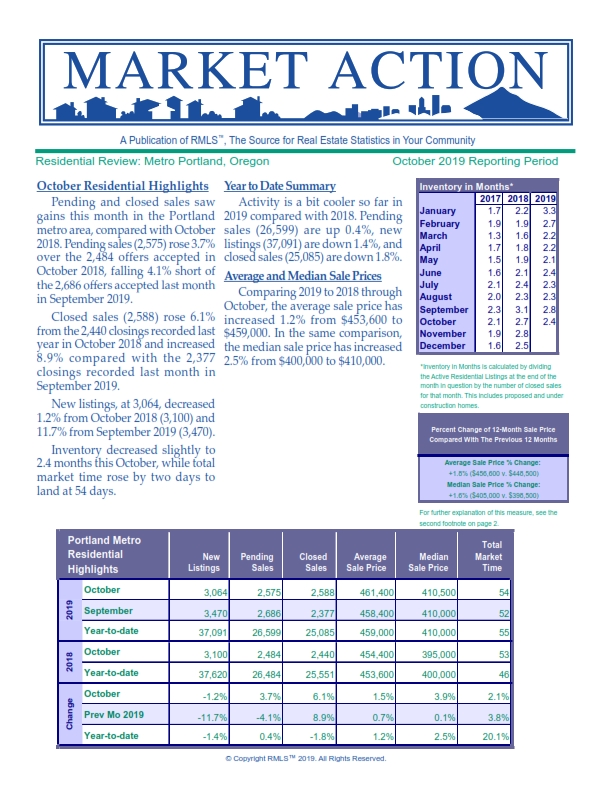

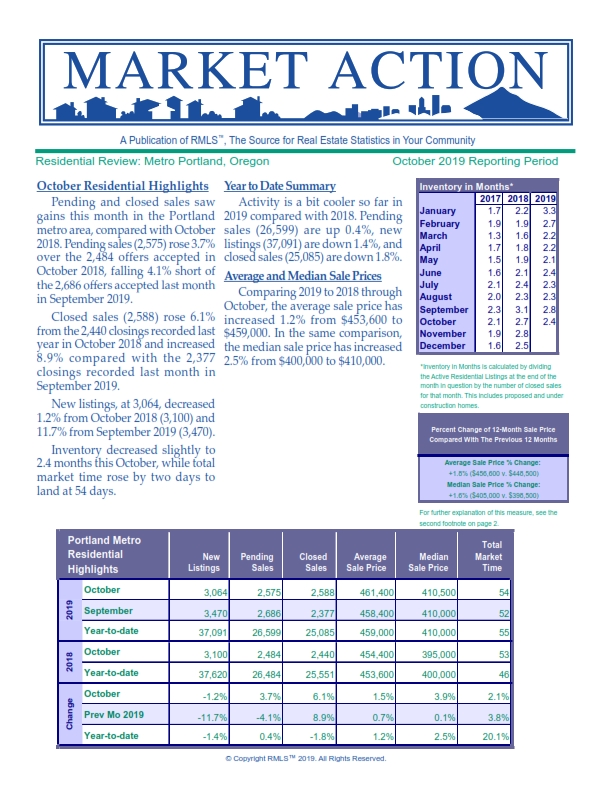

The latest stats came out from the Portland area MLS for the month ending October 31st, 2019 and here they are. Pending and closed sales saw some gains in October when compared to 2018 with pending sales up 3.7%, but down 4.1% when compared to September of this year. For closed sales (keeping in mind the average closing time is about 40ish days) rose 6.7% over last year AND rose 8.9% over September of this year with 2,377 closed sales registered for the Portland metro area (not including Washington State).

The latest stats came out from the Portland area MLS for the month ending October 31st, 2019 and here they are. Pending and closed sales saw some gains in October when compared to 2018 with pending sales up 3.7%, but down 4.1% when compared to September of this year. For closed sales (keeping in mind the average closing time is about 40ish days) rose 6.7% over last year AND rose 8.9% over September of this year with 2,377 closed sales registered for the Portland metro area (not including Washington State).

As for new listings at 3,064 they decreased 1.2% from October of last year and decreased 11.7% compared to September. This results in an inventory slight decline to 2.4 months supply for October.

Year to date, activity is still a bit cooler in 2019 when compared to last year. Pending sales are up 0.4%, new listings are down 1.4% and closed sales at 25,085 so far this year are down 1.8%. When comparing 2019 with 2018 through October, the average sales price has increased 1.2% from $453,600 to a new high of $459,000.

You can view the entire seven page report courtesy RMLS by clicking here.

Our featured home this month is one of the best buys I have seen in a very long time. Its a huge home on 4.2 Acres overlooking the Sandy River and is recently updated. This home is over 6,100 square feet on two levels, has three bedrooms, high cielings, an in-ground pool, a huge mostly finished basement and so much more. You can view teh home here https://www.roblevy.com/Property/28201-SE-SWEETBRIAR-RD-Troutdale-Oregon

_001.jpg) This is an interesting article as I'm living it! Let me digress.... When I started selling real estate in Portland nearly 31 years ago, I mostly sold to my sphere, so other young families with kids. Now fast forward those 31 years and most of those clients are either downsizing, or their parents are moving into independent/assisted living, or passing. As a result a large part of my business is selling homes for seniors, and helping 55+ buyers find homes with a master on the main floor. My wife Beverly and I did just this three years ago.

This is an interesting article as I'm living it! Let me digress.... When I started selling real estate in Portland nearly 31 years ago, I mostly sold to my sphere, so other young families with kids. Now fast forward those 31 years and most of those clients are either downsizing, or their parents are moving into independent/assisted living, or passing. As a result a large part of my business is selling homes for seniors, and helping 55+ buyers find homes with a master on the main floor. My wife Beverly and I did just this three years ago.  I saw a great article recently on The Motley Fool website about how rental properties are taxed. My wife and I have invested in rental homes for many years, some we do out of our personal accounts and some out of our retirement accounts. There are some huge tax advantages to doing either and I am always happy to discuss, but many people ask me "what can I write off on a rental". This article covers this well. The key is even if you think you arent making money on a rental, after taxes and depreciation you are (and thats not counting appreciation).

I saw a great article recently on The Motley Fool website about how rental properties are taxed. My wife and I have invested in rental homes for many years, some we do out of our personal accounts and some out of our retirement accounts. There are some huge tax advantages to doing either and I am always happy to discuss, but many people ask me "what can I write off on a rental". This article covers this well. The key is even if you think you arent making money on a rental, after taxes and depreciation you are (and thats not counting appreciation). The latest stats came out from the Portland area MLS for the month ending October 31st, 2019 and here they are. Pending and closed sales saw some gains in October when compared to 2018 with pending sales up 3.7%, but down 4.1% when compared to September of this year. For closed sales (keeping in mind the average closing time is about 40ish days) rose 6.7% over last year AND rose 8.9% over September of this year with 2,377 closed sales registered for the Portland metro area (not including Washington State).

The latest stats came out from the Portland area MLS for the month ending October 31st, 2019 and here they are. Pending and closed sales saw some gains in October when compared to 2018 with pending sales up 3.7%, but down 4.1% when compared to September of this year. For closed sales (keeping in mind the average closing time is about 40ish days) rose 6.7% over last year AND rose 8.9% over September of this year with 2,377 closed sales registered for the Portland metro area (not including Washington State). ![20 Tips for Preparing Your House for Sale This Spring [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/03/19131813/20190322-ENG-MEM-1046x824.jpg)

It's done.... Oregon today became the first and ONLY state in the USA to pass STATE WIDE rent controls. The new law which took effect immediately today when signed create significant restrictions on property owners. The law while not quite as bad as it looks has some specific rules and many unintended consequences, one of which (speaking as a top Realtor for over 30 years) that I see coming is property owners selling their single family home rentals, and with our prices as high as they are the buyer most likely will purchase for their own use, not as a rental. Therefore there will be fewer rentals, which will mean higher rents. Property owners, be sure to check and see where your rents are in comparaison to market rents. If you get behind and then see increased expenses such as higher taxes, garbage rates, water/sewer etc, you may not be ever able to recouperate those fees unless you keep your rents now at near market rate.

It's done.... Oregon today became the first and ONLY state in the USA to pass STATE WIDE rent controls. The new law which took effect immediately today when signed create significant restrictions on property owners. The law while not quite as bad as it looks has some specific rules and many unintended consequences, one of which (speaking as a top Realtor for over 30 years) that I see coming is property owners selling their single family home rentals, and with our prices as high as they are the buyer most likely will purchase for their own use, not as a rental. Therefore there will be fewer rentals, which will mean higher rents. Property owners, be sure to check and see where your rents are in comparaison to market rents. If you get behind and then see increased expenses such as higher taxes, garbage rates, water/sewer etc, you may not be ever able to recouperate those fees unless you keep your rents now at near market rate.  Here it is again, the Portland Business Journal's hottest neighborhoods for 2018. This also includes the Vancouver, Washington area and it's local communities.

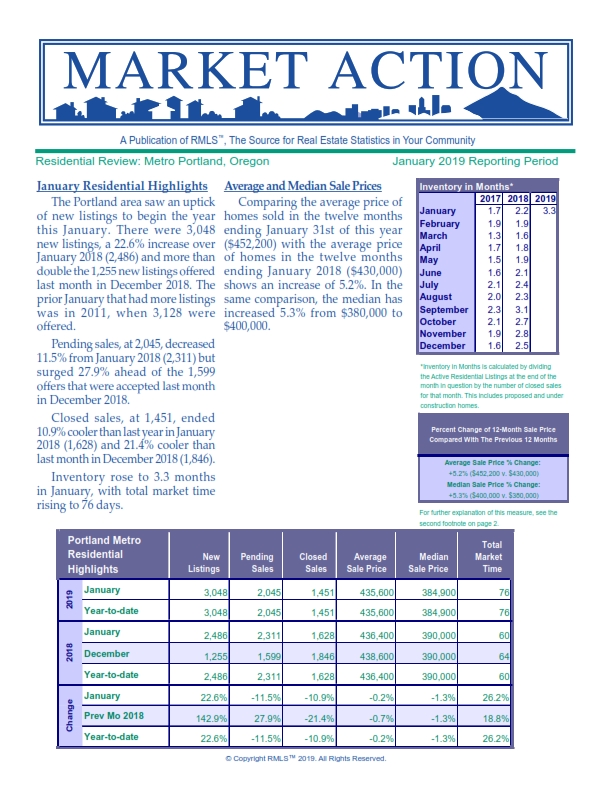

Here it is again, the Portland Business Journal's hottest neighborhoods for 2018. This also includes the Vancouver, Washington area and it's local communities.  The Portland area real estate market sure changed in January of this year! New listings were more than double those in December, 2018 and up 22.6% over January of 2018. As of January 31st there were 3,048 new listings. Also Pending sales surged 27.9% ahead of December, with 2,311 offers accepted by sellers. For Closed Sales, there were only 1,451 which was down 21.4% over December and 10.9% over January of last year.

The Portland area real estate market sure changed in January of this year! New listings were more than double those in December, 2018 and up 22.6% over January of 2018. As of January 31st there were 3,048 new listings. Also Pending sales surged 27.9% ahead of December, with 2,311 offers accepted by sellers. For Closed Sales, there were only 1,451 which was down 21.4% over December and 10.9% over January of last year.